Solar power. Although most homeowners know about this alternative energy source, few realize the exact nature of financial incentives available via federal tax credits. It can be confusing. In fact, the federal tax credit amounts change periodically. We explore the details behind the federal solar tax credit, or solar investment tax credit (ITC), including how to qualify for this exceptional opportunity.

Solar Power: The Future Of Household Energy Consumption

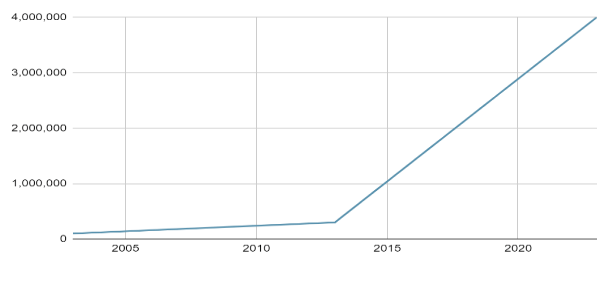

Americans are waking up to the reality that accessing solar energy is easier than ever. In 2013, only about 300,000 homes had solar panels installed. Ten years later, nearly 4,000,000 households utilize solar panels to access energy. Some industry experts estimate that by 2030 (or soon after that), as many as 100,000,000 homes will rely on solar power.

Solar Energy Federal Tax Credit Explained

Concerning the residential solar tax credit, the cost of new, qualified clean energy property/equipment includes (i) the price of the property/equipment itself and (ii) the qualifying installation/labor expenses.

Current Status: Credit Expires Soon

Important Update: Due to recent legislation, the residential solar tax credit will expire on December 31, 2025. However, the 30% federal tax credit is still available for installations completed before this date.

What This Means

Consult with a tax professional and solar installer to understand timing and eligibility requirements.

The 30% federal tax credit is still available for solar installations completed by December 31, 2025.

No federal tax credit will be available for new residential solar installations under this program after December 31, 2025.

Homeowners considering solar should plan installations to be completed before the expiration date.

Check with local and state programs for potential incentives that may continue beyond the federal credit.

Who Can Benefit From The Solar Energy Federal Tax Credit?

Homeowners who purchase (not lease) new solar-powered equipment that produces electricity or provides heated water (or buy solar power storage equipment) can claim a federal tax credit under the Residential Clean Energy Credit.

What Types Of Homes Qualify For The Solar Energy Federal Tax Credit?

For American-based homeowners, the Residential Clean Energy Credit requires the residential property to meet specific criteria. The following list incorporates what kinds of residences qualify:

- Condominium

- Cooperative Apartment

- Houseboat

- Manufactured Home

- Mobile Home

- Single-Family Home

Also, take note of the following standards for qualification under the Residential Clean Energy Credit:

| Qualifies | Does Not Qualify |

| Existing Home As Principal Residence | Located Outside The United States |

| New Construction As Principal Residence | Non-Conforming Manufactured Home |

| Second Home (Personal Vacation Property) | Rental Property (i.e., Not Your Residence) |

What Systems Are Considered Qualified Clean Energy Property?

The IRS permits a homeowner to benefit from energy-saving improvements, including a credit for the cost of purchasing and installing qualified solar energy systems. The homeowner should add any labor costs properly allocable to the onsite preparation, assembly, or original installation of the system (and for piping or wiring to interconnect such system with the home.)

Implementation Of Solar Solutions By An Expert Roofing Contractor

If you own a home in Sacramento, CA, you owe it to yourself to learn more about solar energy. At Straight Line Construction, we love educating homeowners on the benefits of solar power. We have all the solar products to transform your energy consumption habits and help you do your part to protect the environment. To learn more about any of our roofing services or to schedule an appointment, contact Straight Line Construction today.